It began on April 1, 2023, when AB InBev hired several TikTok and Instagram celebrities to promote Bud Light. One was transgender influencer Dylan Mulvaney, who had 10MM followers at the time. A Bud Light boycott followed with the ferocity that would make one think they put Ms. Mulvaney in a Super Bowl commercial. Ms. Mulvaney’s participation led to a social media push to boycott Bud Light and the sales drop-off continues today.

Net net, nationally, Modelo Especial recently surpassed Bud Light as the top-selling beer in the United States year-to-date, according to NielsenIQ data (Forbes, 7/24/23). Bud Light had held the #1 was a slot since 2001. Twenty-two years ago, Bud Light took it from Budweiser.

Advertising Benchmark Index™ (ABX) jumped into the analytics to examine if this controversy was affecting Bud Light’s creative effectiveness as much as its sales. Further, how is Bud Light’s ad messaging across media doing in comparison to Modelo Especial? Is Modelo Especial creatively outpacing Bud Light, too?

ABX is a leading ad effectiveness and consumer insights company with the largest global syndicated measurement solution that evaluates the effectiveness of ads across all media types, competitors, demographic groups and more over time/brand history.

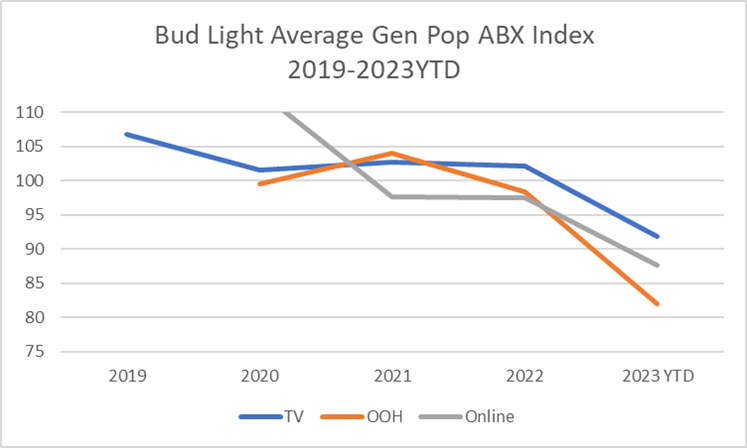

Bud Light Average Performance 2019-2023

It seems that the controversy affected not just sales, but how consumers were reacting to the Bud Light message overall. The chart below tracks the average Advertising Benchmark Index™ (ABX Index™) scores across all of Bud Light’s ads tested in the U.S. by medium. As you will note, Bud Light had a significant fall off in 2023 YTD in its Television, Online Video and Out of Home (OOH) ad scores.

Bud Light Top Ads Comparison 2019 and 2023

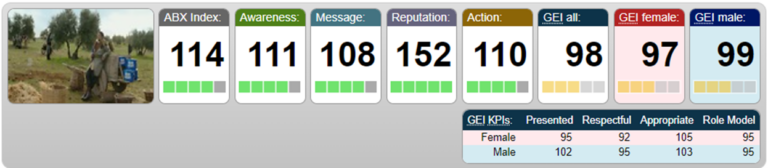

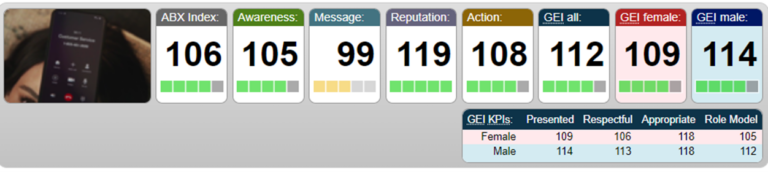

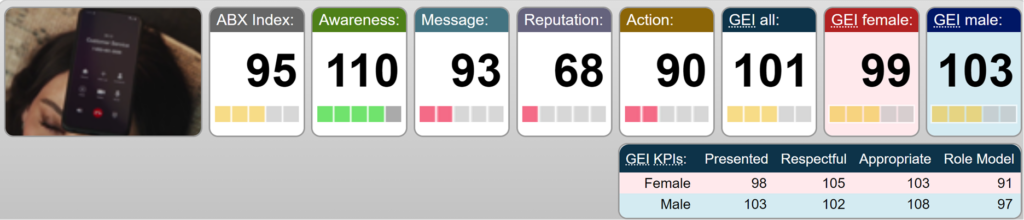

We also compared the details of the top-scoring ad in 2019, when Bud Light was running its “Bud Light Knight” campaign versus the top-scoring ad in 2023, the Bud Light “Easy to Drink/Enjoy” campaign.

As you may have predicted, the factor driving the score down in 2023 is a tremendous decline in Reputation. The ABX Reputation score is similar to Net Promoter, which measures how respondents feel about a company or brand after seeing an ad. Bud Light’s Reputation score for the ads below were 152 (2019) and 119 (2023), despite the Intended Action scores being statistically similar at 110 (2019) and 108 (2023).

- Bud Light 2019 “Bud Light Knight – Ingredients” :60 (see ad)

- Bud Light 2023 “Easy to Drink/Enjoy – Freeze Dance” :60 (see ad)

Bud Light versus Modelo Especial Across All Media Types

Then, we looked across all media types to see the top-scoring executions, to ascertain which were the top-scoring executions and the means of all ads tested.

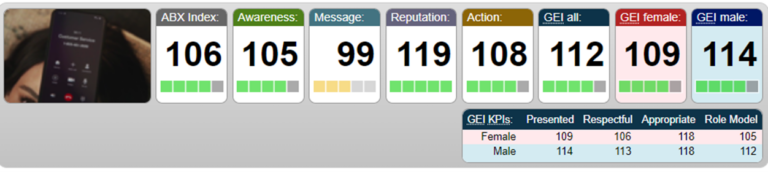

For Bud Light, “Freeze Dance,” TV is not just their top TV spot, but their highest-scoring ad year-to-date with a Gen Pop ABX Index™ of 106. Their mean execution is a :06 TV and Online Video spot with an ABX Index™ of 92.

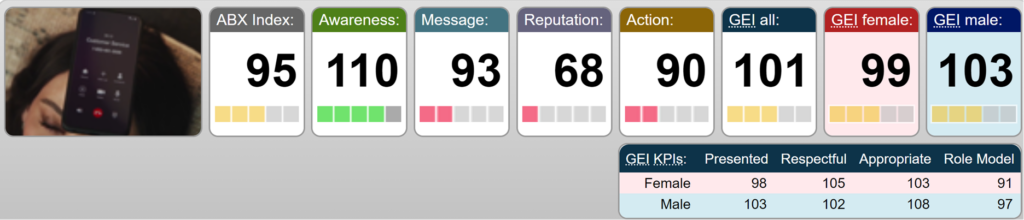

For Modelo Especial, their top-scoring ad year-to-date is a Spanish-language OOH billboard with a Gen Pop ABX Index™ of 107, and their mean execution is a :30 TV spot with an ABX Index™ of 98.

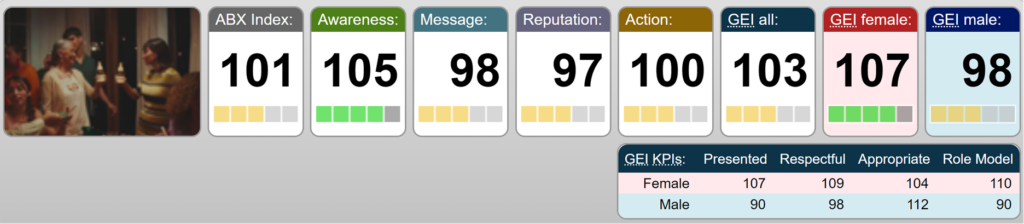

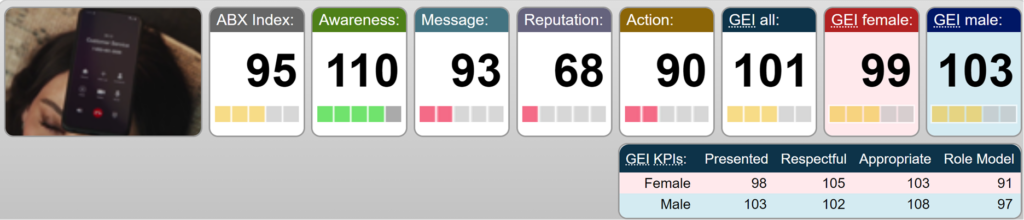

Because ABX uses the same KPIs across all media, we are able to view a competitive side-by-side for each medium. Below are the top TV, OOH and Online Video ads for each Brand in 2023.

BUD LIGHT 2023

TELEVISION

“Easy to Drink/Enjoy” campaign (see ad)

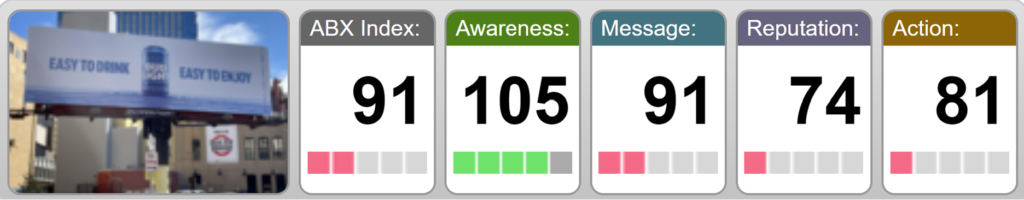

OUT OF HOME (OOH)

“Easy to Drink/Enjoy” campaign (see ad)

ONLINE VIDEO

“Easy to Drink/Enjoy” campaign (see ad)

MODELO ESPECIAL 2023

TELEVISION

“The Mark of a Fighter” campaign (see ad)

OUT OF HOME (OOH)

“The Mark of a Fighter” campaign (see ad)

ONLINE VIDEO

“Easy to Drink/Enjoy” campaign (see ad)

Interestingly, side-by-side, there is not a significant difference between the two campaigns. Bud Light’s “Easy to Drink/Enjoy” TV spot does a bit better than Modelo Especial’s “The Mark of a Fighter” TV spot. While in Out of Home, it is the reverse, with the Modelo Especial posting scoring a bit higher than the Bud Light posting.

It’s important to note that both brands’ ad effectiveness scores for their best ads were just at, or below, the ABX Index Norm for the Beer Category of 106. While Modelo’s ad effectiveness was a little better than Bud Light’s, Modelo could have seized the moment and produced killer ads at any cost.

CONCLUSION

The dots are all connected. Advertising effectiveness for any brand is greatly affected by non-paid media such as news and social media. As evidenced by the Bud Light saga, paid advertising performance alone could not have accounted for the -30.6% decrease in Bud Light sales volume for the four weeks ended 9/23/23, or for +7.7% increase for Modelo Especial (Ad Age 10/4/2023).

News impact on advertising has been studied in great depth by the Institute for Public Relations Measurement Commission such as the major study conducted by Angela Jeffrey and Gary Getto of ABX, “How does Non-Paid Media Impact the Effectiveness of Paid Ads: An Exploration with AT&T and Hotels.com.”

A brand cannot hide from non-paid media impact. If news is negative, PR studies prove the best strategy is to hit the issue directly in paid-media messaging. Since Bud Light has not altered its “Easy to Drink/Enjoy” messaging pre-Mulvaney and post-Mulvaney, it is no surprise that its ad effectiveness is lack-luster.

Written by Marc Rappin, Advertising Consultant & Contributing Writer, former CMO of ARF